The Business Politician in Power: How Private Interests Shape Public Policy

What happens when businesspeople win office? Does their experience yield leaner, smarter governance, or do their private interests follow them into public service? While the first installment of this series explored why business elites run for office and how they build winning coalitions, this piece turns to what happens after they win. Do they govern differently than career politicians? And what does their rise mean for domestic and international policymaking?

We’ll examine those consequences across three domains: how they legislate and regulate, how they govern at home, and what kind of global posture they bring to foreign affairs.

The False Promise of Business Efficiency

Business-politicians in the US often come with two messaging stripes. The first, most associated with Republican candidates, is fire and fury - they will have the will to break through the special interests and upend the status quo. An alternate, more humble approach, is the business-candidate that emphasizes the cooperative side of commercial development. Politicians with business skills should know how to cut deals, leaving partisanship by the wayside.

To assess these logics, Keena and Knight-Finley (2025) identified 94 business-senators with 24 serving in their latest round of data (2021-2022). These individuals represent a fairly even split across parties: 41 as Democrats, 53 as Republicans. Amateurs with no previous political office were rare: 9 out of the 41 for Dems and 12 out of 41 for the GOP.

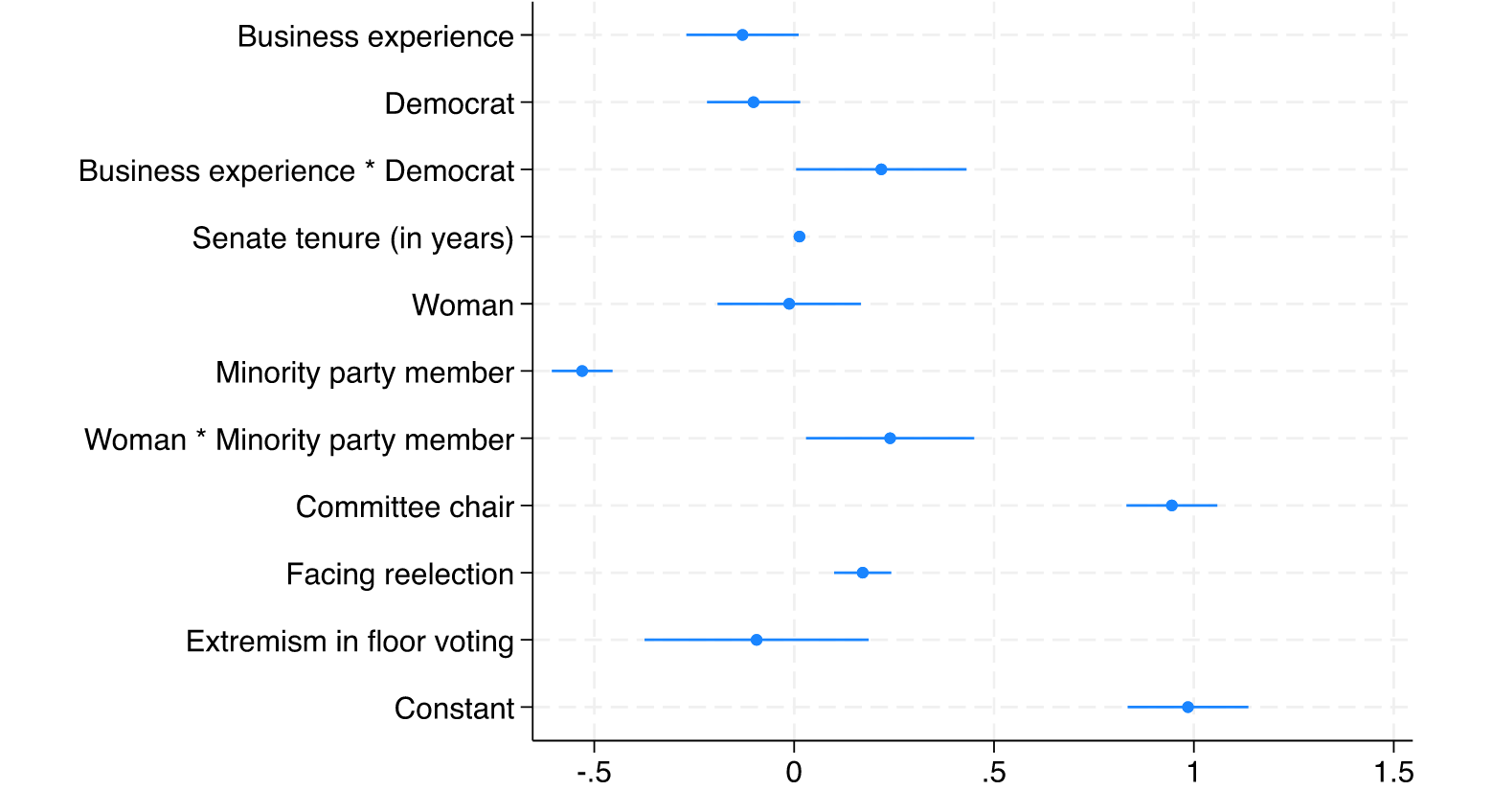

They then assess how effective these politicians are as legislators using the highly cited measure by the Center for Effective Lawmaking. The results are displayed in the figure above. If the dot corresponding to the legislator's characteristics is to the right of 0, that's a positive effect. To the left and it's negative. If the bars attached to the dot cross the 0 then the effect is not statistically significant.

The key takeaway is that, in general, business politicians don't differ very much from the standard track - if anything they are worse. But when you factor in partisanship we do see that Democratic business politicians are the most effective. In the authors' words:

Democrats with business experience have the highest legislative effectiveness scores, while Republicans with business experience have the lowest, all else equal

We see similar effects at play with Members of the European Parliament - the higher the individual is earning from activities outside of politics, the less effort they tend to put into legislating. But the harder it is to get elected, the more even the rich politician needs to try.

Legislating is hard. Actually initiating or sponsoring bills tends to be most correlated with chairing a committee or becoming a senior member in general. Given business-politicians have had prior careers, and therefore usually less political experience, these tests could be unfair. So we could look at how they vote on issues instead.

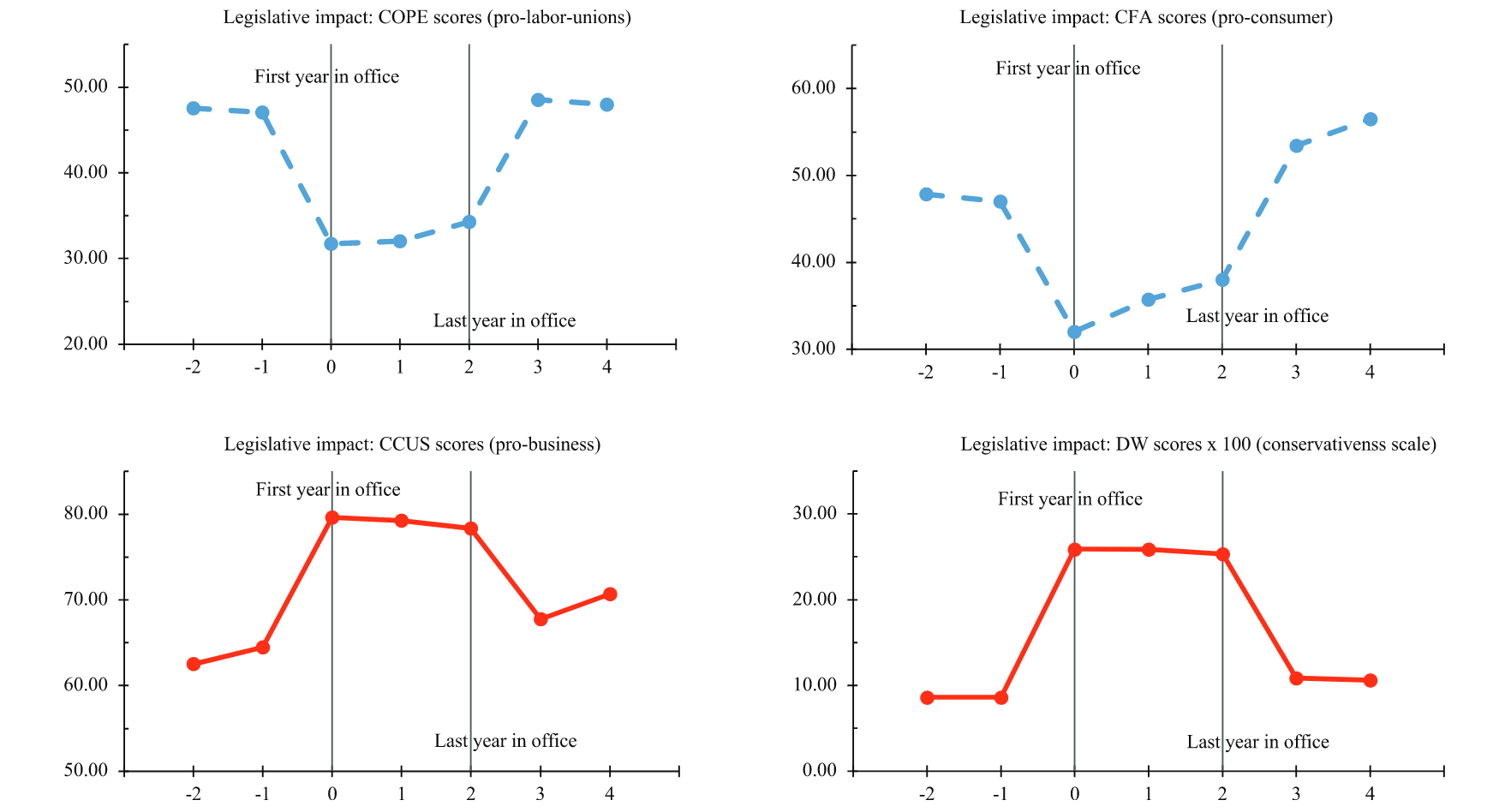

To identify whether business-politicians behave like the normal kind, Babenko et al. (2023) compare their voting records to individuals that help the seat before and after the businessperson. This is the same constituency. Largely the same population voted each of these candidates into office.. As the figure below shows, business-politicians are far more likely to vote for pro-corporate bills and against labor protections-—even after controlling for partisanship.

In other words, voters may not get the same ideological package they thought they were electing—what looks like a Republican or Democrat may, in practice, govern much more like a corporate board chair.”The authors further verify their analysis by honing on business-politicians who were "randomly" brought into office through close elections. The results are largely the same.

How Do Business Politicians Govern?

Business elites generally come to office with a budget-balancer’s mindset. In a study of European democracies, politicians with business experience are significantly more likely to pursue fiscal consolidation, opting to cut spending over raising taxes. We see a similar austerity mindset with US Governors that served as CEOs. Typically elected during fiscal crises, they often promote consolidation, with uneven short-term boosts in employment and income.

But the politicians we were discussing in the previous section have relatively limited autonomy - they are part of far larger voting groups rather than leading. So it's useful to instead move to the local level to see how they act as political executives. In both democracies and autocracies, business politicians don't just reshape spending levels. They reshape spending priorities.

In her study of US city mayors, again using close elections to assess causal effects, Patricia Kirkland (2021) looks at a wide range of economic and policy outcomes. While business-politicians often promise lowering taxes, she finds limited effects. Tax revenues do however increase but they tend to be a function of changing charges for municipal services. Interestingly, for individuals that are often considered frugal, the study finds that business-mayors do frequently take on more debt though the results depend on the model specification.

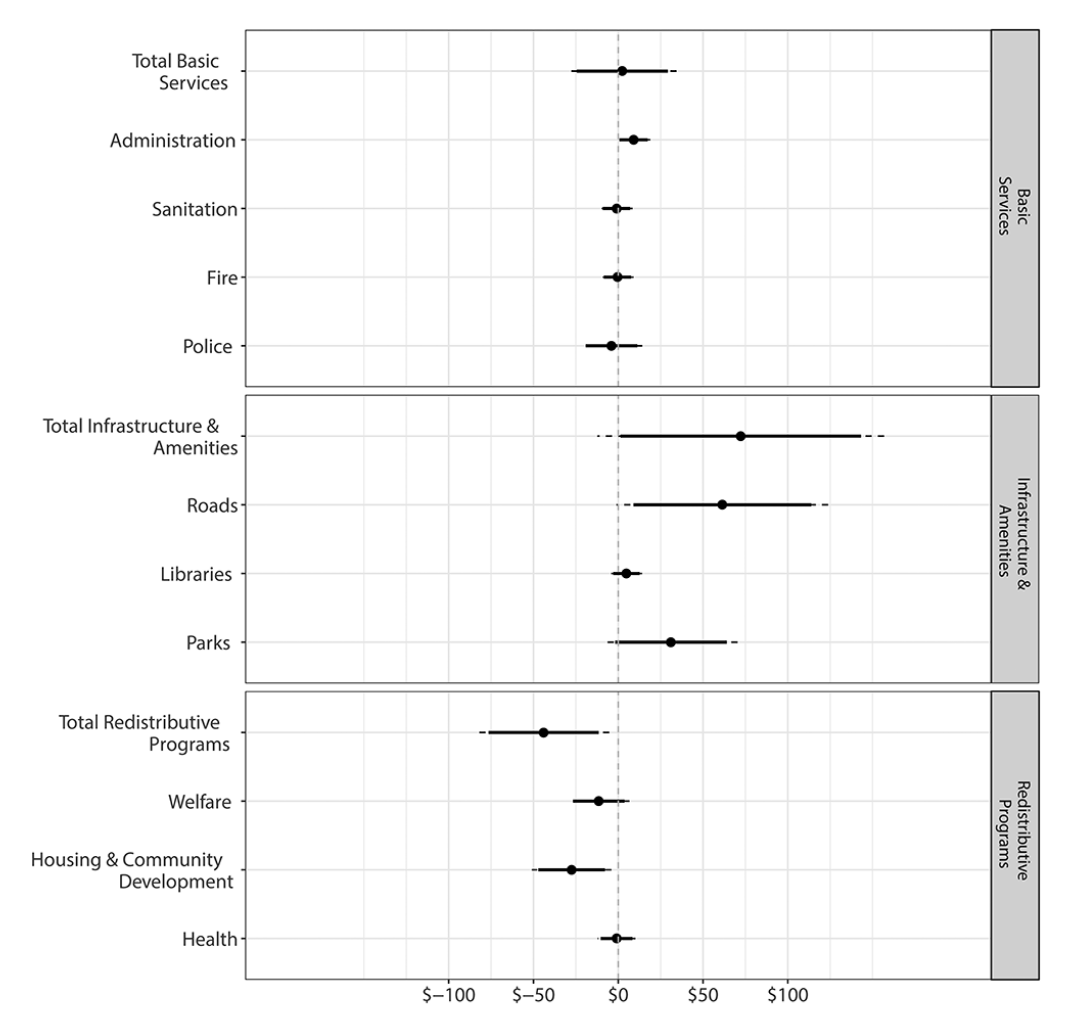

Spo where does all the money go? The figure below illustrates a robust pattern: infrastructure. Roads are no doubt public goods, but more spending in this domain often leads to lower business costs through better transportation. By contrast, it is social welfare that sees the largest cuts consistently, particularly around housing and social development.

These results are remarkably consistent with work by David Szakonyi (2021) on Russia. Businessperson mayors in Russia increased expenditures on roads, ports, and economic infrastructure. But there were no changes to education, health, or social services.

Part of the logic behind this is again about increasing indirect benefits to business, but there is an additional vector at play. Procurement processes shift away from competitive auctions—particularly in construction—and state contracts flow to politically connected firms. A lack of transparency pays.

It's hard to fault a politician spending on infrastructure that has well-established broad benefits. It's especially hard in a context like the US that has suffered from dilapidating roads and bridges. But it's the trade-offs that become a lot trickier.

As Szakonyi notes, when it comes to the costs of reducing education or social service spending, we're likely trading off short term gains for long term losses to growth potential. Moreover, few avenues of government spending offer the opportunity to dole out favors more than infrastructure.

The Global Consequences of the Business Politician

Most successful businesspeople today rely on some form of international trade via global supply chains to buttress their economic fortunes. That's globalization. Their experience with both the gains and pains from trade are then plausibly going to affect their orientation to the global economy when in office.

Recent work Nones (2024) illustrates as much. Building on some of the datasets mentioned across this series, he coded the business backgrounds of leaders across 180+ countries during the post-war period. Business experience in a tradable sector - such as agriculture or tech - makes a leader 34% more likely to sign new trade agreements.

Remarkably, the effects of a business politician as the head of a government has nearly three-quarters of the same substantive effect as a country being a democracy - one of IPE's core findings on the likelihood of a country embracing international trade. The agreements that they sign tend to be far deeper as well.

The results are largely correlational but Nones uses a clever instrumental variable to get around concerns that only some types of individuals first self-select into business. Personalities rather than socialization effects of working in business rooted in trade could be driving the results - so he uses the politician's father's business experience as an alternate measure.

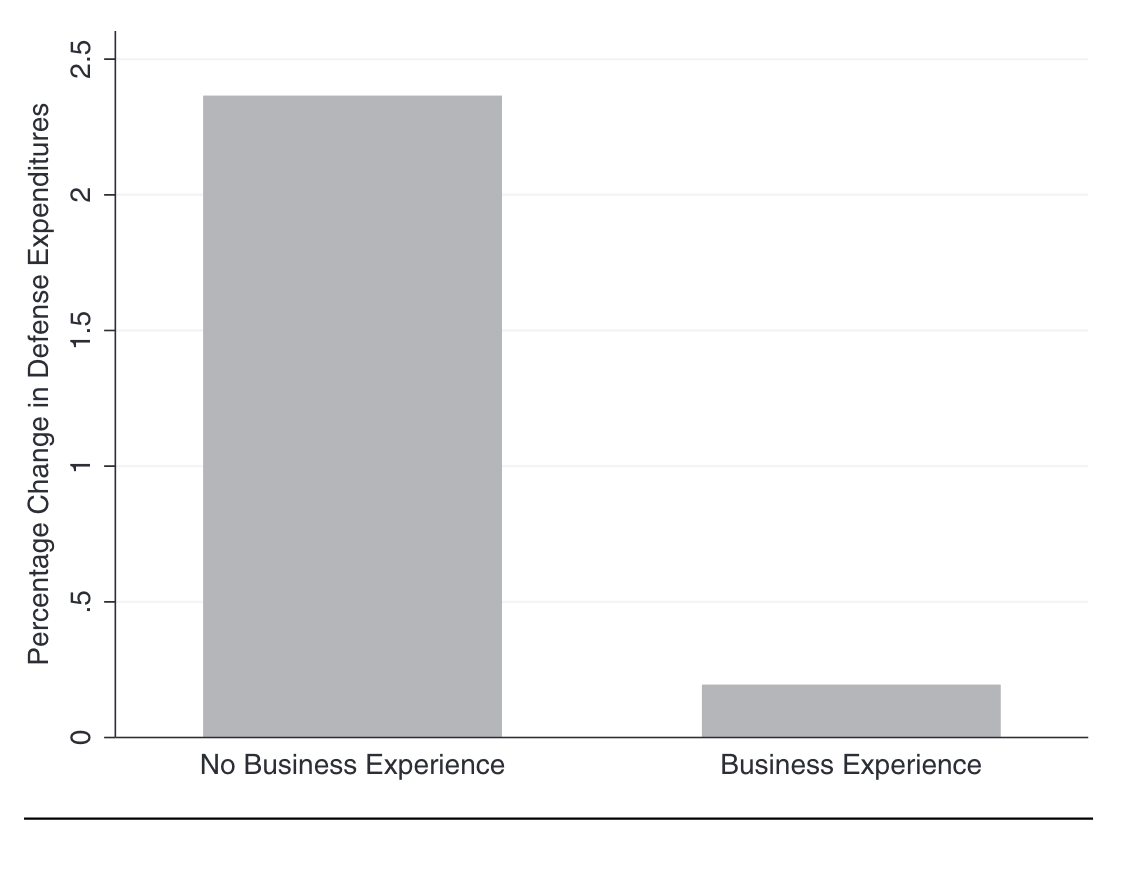

You are probably thinking this really does not fit with trade policy under Trump. It does not. But he worked in real estate and construction - not tradable sectors. That said, how business leaders engage with national security does seem to track the current President's behavior. Fuhrmann (2020) finds that NATO leaders with pre-office business experience spend less on defense. They "free-ride" on the fact that the rest of the alliance and, in particular, the United States spends so much on defense. The raw stats are enough to show the story - business leaders are far less likely to increase defense spending than conventional heads of state.

The effect isn’t driven by partisanship or economic conditions. Nor is it part of a broader austerity binge. The same leaders do not reduce other forms of social spending. Their cuts are strategic—not broad austerity, but targeted retrenchment in areas they see as yielding low ROI, like multilateral defense.

Fuhrmann's collaborative work with Kim (2024) helps clarify the logic. They find that the cuts are only likely with politicians who have held senior business posts prior to office. That points to a durable imprint from the business world, not just post-office career planning. That tracks the findings on trade - it's socialization from the business world, rather than the personal or psychological traits that push one into business, that dictate how these politicians engage with other countries.

The Business Politician’s Blueprint

Businesspeople in office govern differently. They prioritize infrastructure over redistribution, cost-cutting over new taxation, and competitive advantage over equal provision. In the legislature, they don’t always outperform, but they reliably align with business interests. And in the global arena, they push for leaner defense budgets and expanded market access. Sometimes, these decisions serve the broader economy. Mostly they serve the firms and sectors from which these leaders came.

What’s clear is that business politicians bring a distinct worldview—shaped by risk calculations, capital incentives, and deal-oriented logic. Understanding that blueprint is key to understanding how modern governance is evolving—not just in Washington, but in Warsaw, Bangkok, and beyond.